It’s time for another guest blog post from one of our operational partners. This time we hand over the reigns to Deepak Goyal, Tipalti’s Director of Alliances and Business Development. Tipalti is the only company handling both accounts payable and global partner payments for mid-market companies across the entire cycle: funding global entities, onboarding the global supply chain, streamlining invoice workflows, instituting procurement controls, and reconciling data.

Deepak explains how businesses can negate issues caused by accounts payable (AP) exceptions and eliminate time-hungry tasks…

It’s no secret that a sophisticated ERP like NetSuite is critical for tracking finance, accounting, and business operations. It functions as an important system of record that collects, stores, manages, and monitors essential business data. But for accounts payable (AP), NetSuite is more a map than a vehicle. ERPs are not designed for in-depth payables execution and process-heavy operations like payables, and as a result, AP is often backfilled with staff.

Although NetSuite can create purchase orders and store invoices from suppliers, it does not manage the payables operation completely. That is still relegated to human beings having to travel that last mile and back. These steps are time-consuming and labour-intensive. They also create opportunities for errors that are costly both financially and legally.

ERP systems have generally not addressed this in depth because it’s not their core focus. AP is consistently ranked by financial executives as the single most time-consuming function in finance. It ends up being the last mile that CFOs and controllers address.

The Drive for Automation

The Accounts Payable Association (APA) estimates that at any one time there are more than 250,000 people working in accounts payable (AP) in the UK alone. It also estimates that around 3.6 percent of invoices manually entered include an error caused by data entry, while a survey of businesses processing 350,000+ invoices per year noted how the problems caused due to AP exceptions on invoices equated to 32 percent of all late payments and 36 percent of all supplier related phone calls.

It’s no wonder then, that modern businesses across a wide variety of industries, are embracing automation. In fact, financial automation is fast becoming a key priority for businesses of all sizes. Increasing numbers of businesses are seeing the benefits of automating their accounts payable functions, with benefits including increased accuracy, time saved for finance personnel to move from data inputting to strategic planning and the ability to grow a business more quickly.

The Last Mile of NetSuite

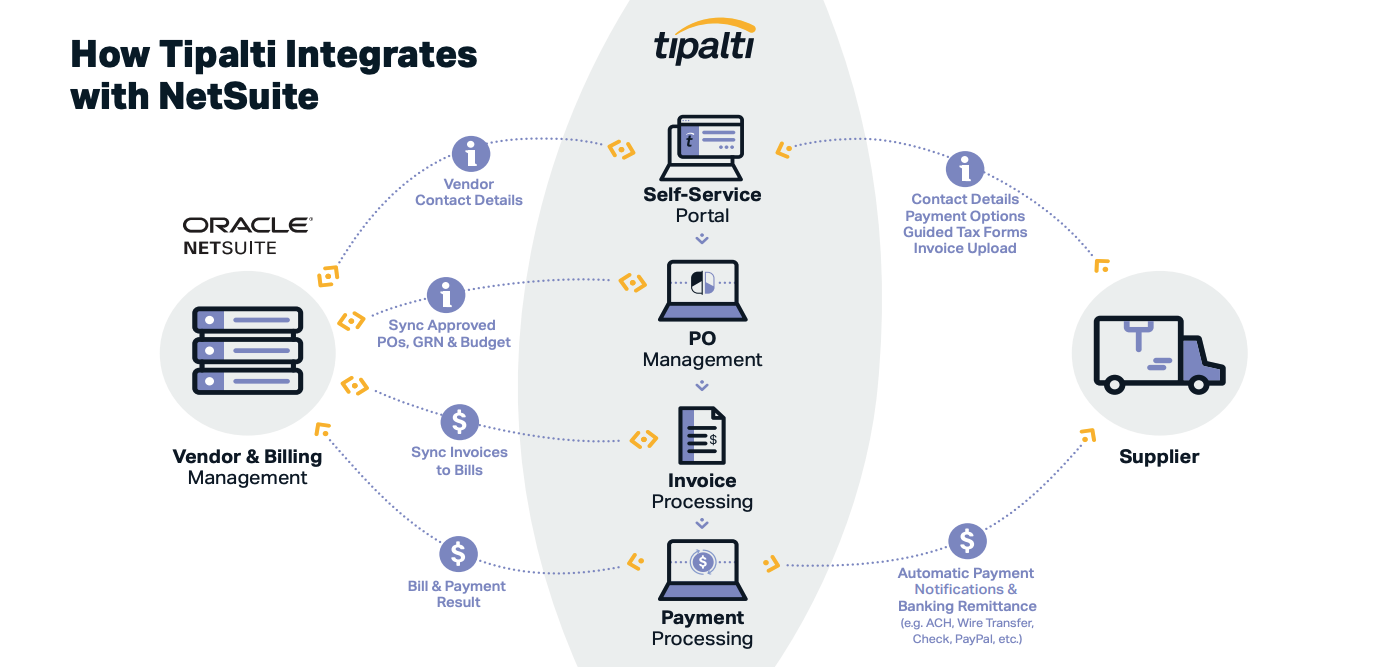

A cloud ERP like NetSuite is the utopian platform for vendor and billing management. Tipalti extends existing NetSuite capabilities by providing full management and automated execution of AP processes including supplier onboarding, invoice management, payment scheduling, remittance through bank integrations, communicating with suppliers, and reconciliation of payment details with invoices and billing.

With the NetSuite OneWorld-Tipalti integration, users can eliminate up to 80% of the workload related to managing payments to domestic and international suppliers. Tipalti automates your entire accounts payable process, from new vendor set up through to invoice processing, 2-way and 3-way PO matching, global supplier remittance, and payment reconciliation.

About Tipalti

For high-velocity businesses, Tipalti provides a comprehensive, multi-entity accounts payable solution. Tipalti customers typically wipe out 80% of their payables effort, enabling them to focus on real business.

Every step in the payables process – including self-service onboarding and managing suppliers, processing and approving invoices, executing global payments, and reconciliation – is fully self-contained and backed with integrated AI and machine learning. It’s the ideal upgrade from other AP automation products.

Tipalti’s commitment to being customer-first has culminated in a 98% customer retention rate with brands large and small, including Twitch, GoDaddy, Roku, Twitter, and Headspace.

If you want to learn more about NetSuite with Tipalti integration, or discuss adding this multi-entity payable solution to your existing NetSuite system, request a callback from one of our ERP consultants.

About the author: Deepak Goyal joined Tipalti’s leadership team in early 2021 and leads on developing Alliance relationships with ERP ecosystems within EMEA. Deepak has been providing local and global payables advice to SMEs and mid-market business for over 15 years.

Keep reading

What is a NetSuite implementation partner? How do you choose one?

Technology fit for total customer service in 2024

Retail and wholesale distribution: how to improve supply chains

Ditching Sage 1000: what you need to know from businesses that have done it

6 ways AI-ready Microsoft Dynamics 365 helps chartered associations serve members

6 retail and wholesale distribution challenges and how NetSuite solves them

The most exciting features in Microsoft Dynamics 365 2023 Release Wave 2

How to manage a new NetSuite Release: one expert's update process

What’s in NetSuite Release 2023.2?